The Only Guide to Offshore Banking

While many domestic accounts limit your capability in holding various other currency religions, accounts in Hong Kong or Singapore, for instance, permit you to have upwards of a lots currencies to selected from done in just one account. 8. International Accounts Gives You Greater Property Protection, It pays to have well-protected funds.

Without any kind of access to your properties, exactly how can you protect on your own in court? Money and also assets that are maintained offshore are much more challenging to take due to the fact that foreign federal governments do not have any kind of jurisdiction as well as for that reason can not compel banks to do anything. Regional courts as well as governments that control them just have actually restricted influence (offshore banking).

, that is not too unusual. If you are struck with a claim you can be basically reduced off from all your properties prior to being brought to test.

With an overseas LLC, Limited Business or Trust fund can supply a procedure of confidentiality that can not be discovered in any kind of individual residential account., the CRS and also the OECD have drastically reshaped financial privacy.

Top Guidelines Of Offshore Banking

Utilizing candidate supervisors can also be utilized to create another layer of safety that removes your name from the documents. Takeaway, It is never ever as well late to develop a Strategy B.

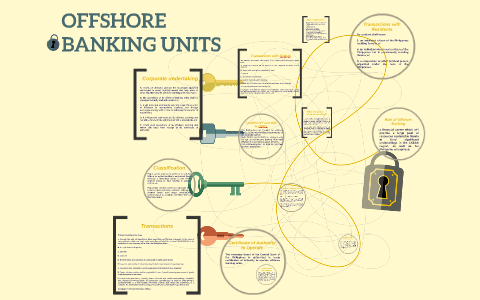

What Is Offshore? The term offshore refers to a place outside of one's home nation. The term is frequently made use of in the financial as well as economic sectors to define areas where regulations are different from the house nation. Offshore places are normally island countries, where entities set up companies, financial investments, and deposits.

Boosted pressure is causing more reporting of foreign accounts to global tax authorities. Understanding Offshore Offshore can refer to a selection of foreign-based entities, accounts, or various other monetary solutions. In order to certify as offshore, the activity happening has to be based in a country besides the business or investor's residence country.

Offshoring isn't normally unlawful. Yet hiding it is. Special Factors to consider Offshoring is perfectly lawful because it provides entities with a fantastic bargain of privacy as well as discretion. However authorities are concerned that OFCs are being made use of to prevent paying tax obligations. Thus, there is enhanced pressure on these countries to report international holdings to international tax obligation authorities.

The Best Strategy To Use For Offshore Banking

Kinds of Offshoring There are several kinds of offshoring: Company, spending, and also banking. This is the act of establishing particular service features, such as manufacturing or phone call facilities, in a country various other than where the business is headquartered.

Companies with significant sales overseas, such as Apple as well as Microsoft, may seize the day to maintain related revenues in offshore accounts in nations with lower tax obligation burdens. Offshore Investing Offshore spending can include any kind of scenario in which the offshore investors stay outside the nation in which they invest. This technique is mainly made use of by high-net-worth financiers, as running offshore accounts can be particularly high.

This makes offshore spending past the ways of the majority of investors. Offshore investors may also be scrutinized by regulatory authorities and also tax obligation authorities to ensure tax obligations are paid. Offshore Financial Offshore financial includes safeguarding assets in financial institutions in foreign nations, which might be limited by the laws of the customer's residence nationmuch like overseas investing.

Offshore jurisdictions, such as the Bahamas, Bermuda, Cayman Islands, and also the Island of Man, are popular and also recognized to use fairly secure financial investment chances. Benefits and Disadvantages of Offshore Spending While we have actually listed some normally accepted benefits and drawbacks of going offshore, this section considers the benefits and drawbacks of overseas investing.

The Main Principles Of Offshore Banking

This suggests you could be responsible if you do not report your holdings. You ought to do your due diligence if you're mosting likely to invest abroadthe same method you would if you're collaborating with someone in your home. Make sure you select a credible broker or investment professional to guarantee that your money is managed effectively.

What Is Onshore and also Offshore? Onshore means that company activity, whether that's running a business or holding possessions as well as financial investments, takes area in your house nation. Going offshore, on the other hand, implies these activities occur in another country, area, or territory. Are Offshore Accounts Legal? Offshore accounts are completely legal, as long as they are not utilized for illegal functions. offshore banking.

These accounts are typically opened for a holding firm instead than a person. Trading by doing this provides capitalists with favorable tax therapy, which places more cash back right into their pockets. The Bottom Line Going offshore is normally a choice meant just for companies or people with a high total assets.

Please confirm that you are human.

The Best Strategy To Use For Offshore Banking

Offshore banking refers to keeping your money in an account situated outside of your very own nation of house, normally at a bank in one more nation. The idea behind overseas banking is that the rate of interest you gain on the money you transfer in this account can be tax-free, since a lot of governments will not enforce taxes on cash made overseas by their people and also companies.

Look At This important site continue reading this